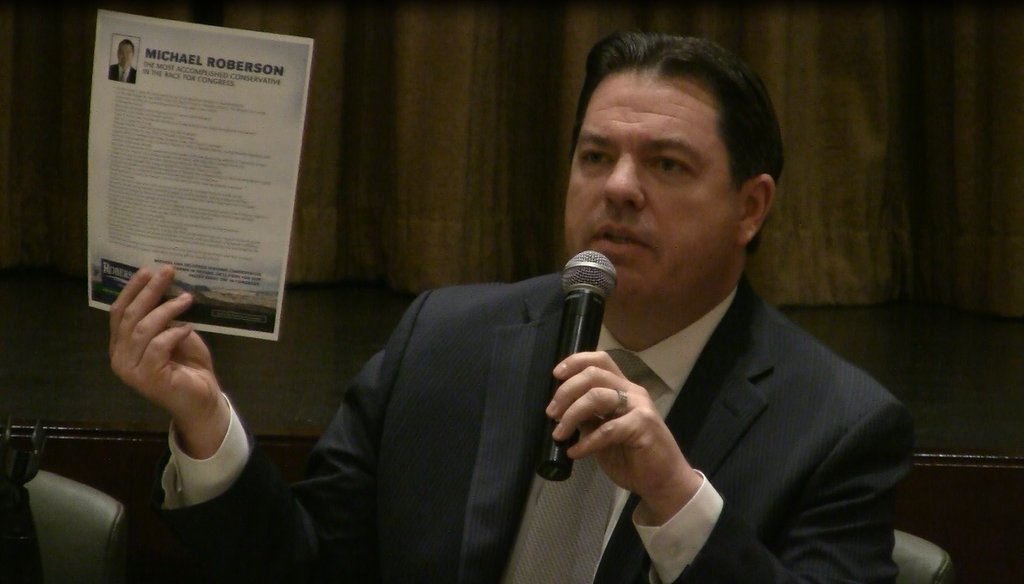

Nevada Senate Majority Leader Michael Roberson holds his campaign flyer during a congressional candidate forum on March 3, 2016.

Some Nevada Republicans are making a curious claim that they actually cut taxes in 2015, despite mountains of headlines proclaiming a "record" tax package to the tune of $1.4 billion.

State Sen. Majority Leader Michael Roberson, who’s running for the state’s open 3rd Congressional District Seat, has claimed in candidate forums and on campaign flyers that lawmakers "permanently cut taxes for over 95 percent of Nevada’s businesses."

"I doubt anyone in this room is paying higher taxes based on last session," he told the audience at a candidate forum in early March. "We cut taxes on 95 percent of all businesses in this state."

Digging into this claim, however, tells a different story — one that requires a little historical backtracking.

Roberson’s claim centers entirely on changes made to the state’s payroll tax. Lawmakers initially approved the tax as part of the chaotic 2003 legislative session. Needing money for new K-12 education programs, the Legislature came to a compromise of $836 million in revenues, primarily from a payroll tax applied to businesses at a 0.7 percent rate (financial institutions and banks paid a 2 percent rate).

That rate was lowered to 0.63 percent by 2007, but at that point the national foreclosure crisis began to decimate Nevada’s tourism and sales tax-driven economy and eventually left a massive budget hole.

Facing massive budget cuts and a governor rabidly opposed to any new taxes in 2009, legislators passed a last-minute $780 million tax to stave off proposed massive cuts to education, health care and other "essential services."

Republican lawmakers were able to negotiate a two-year expiration date into the deal, which included raises in the state sales tax, vehicle registration fees, payroll tax and business license fees.

These so-called "sunset taxes" also created two tiers of rates in the previously universal payroll tax, designed to give smaller businesses with fewer employees a break from the increased rate.

The tax was changed in 2011 to totally exempt businesses with less than $62,500 in quarterly payroll from paying into the tax, with another two-year expansion of the "sunset" taxes approved by lawmakers.

By the next session in 2013, some lawmakers began publicly angling to make the "temporary" tax increases permanent, as it made up a significant chunk of the budget. Legislators ended the session by approving yet another two-year extension of the "sunsets," including raising the exemption level to quarterly payrolls of $85,000.

In 2015, the tax conversation shifted. Republican Gov. Brian Sandoval, who begrudgingly kept the "sunset" tax package in 2011, proposed a bevy of tax increases to pump millions of dollars in the state’s lagging K-12 education system.

After fighting over several potential revenue plans, legislators settled on an oft-quoted figure of $1.4 billion in new and extended taxes. The "extended" portion comes in part from the payroll tax, which lawmakers ended up broadening by lowering the exemption cutoff to $50,000 in quarterly payroll and a 1.475 percent tax on any payroll above that.

Still with us? All this means lawmakers actually expanded the payroll tax in 2015, capturing around 5,100 more businesses than in previous years by lowering exemption levels and raising the tax rate by 0.305 percent.

So how does that equal a tax cut?

Roberson’s campaign argues that making the "sunset taxes" permanent effectively locks in exemptions for businesses with smaller payrolls, thereby avoiding chances of returning to the previous universal rate for all businesses.

"Unlike previous legislatures, the 2015 GOP majority made those Nevada small businesses exempt from the payroll tax permanently instead of just a temporary fix as in years prior," Roberson campaign spokesman Jeremy Hughes said in an email.

That’s not the usual definition of a tax cut, as no businesses are paying less in taxes.

Rather, the remaining businesses under the threshold avoided the possibility of paying the tax if the "sunset" package expired, and will (likely) avoid future uncertainty over legislative quibbling on extending taxes every two years.

Whether or not eliminating the possibility of raising taxes counts as a tax cut is an open question, Nevada Taxpayers Association president Anna Thornley said.

"The elimination of the uncertainty is definitely a plus but whether or not it can be considered a tax cut is in the eye of the beholder," she said in an email.

But Roberson’s claim has more issues.

Nevada had approximately 53,000 businesses with taxable wages in the 2014 fiscal year, but only around 18,600 had a large enough payroll to actually land above the new threshold created in 2015.

Roberson’s campaign uses the total number of businesses in the state (333,000) to get to the 95 percent figure, but that’s misleading because a large percentage aren’t traditional businesses — they fall into a laundry list of pass-through corporations, small businesses and other non-payroll dependent entities, like an LLC set up for real estate.

Even if lawmakers decided to sit on their hands and allow the temporary taxes to expire, the tax burden would only expand to affect those 53,000 businesses — but no change would come to the majority of registered businesses.

Using the campaign’s methods, only around 11 percent of businesses registered in the state dodged the bullet of a potential tax increase. The percentage rises to roughly 66 percent exempted if you only include the applicable 53,000 businesses, but that’s still a far cry from 95 percent.

Use of the word "permanent" is also questionable, as legislators could revisit payroll tax rates sometime in the future. Unlike statutes governing taxation in the state constitution, lawmakers only need a two-thirds majority vote to change the rate.

Narrowing the focus to just the payroll tax ignores multiple other tax changes that happened in 2015. Business license fees increased from a flat $200 to a multi-tiered structure, with corporations paying $500 and others still paying $200 (the fee was scheduled to decrease to $100 before lawmakers increased it).

Lawmakers also approved a new "Commerce Tax," based on total business income without discounting costs or expenses. The tax is more limited than other proposals, exempting the first $4 million in business revenue per year and sources of income already subject to a gross-receipts tax, like mining and gambling.

Although Sandoval signed the tax into law last June, the battle is still raging on with a group of anti-tax Republicans led by Controller Ron Knecht fighting to put a partial repeal of the "Commerce Tax" on the 2016 ballot.

Our ruling

Republican congressional candidate Michael Roberson said lawmakers "permanently cut taxes for over 95 percent of Nevada’s businesses."

The changes made to Nevada’s payroll tax aren’t a traditional tax cut. No businesses saw their net tax bill decrease, but many businesses no longer have to worry every two years that their tax bill might suddenly rise. Still, the 95 percent figure isn’t accurate, even if we accept such a generous definition of a tax cut. And narrowly focusing on one tax change ignores many other tax increases passed by lawmakers.

We rate this claim as False.

Email interview with Anna Thornley, president of Nevada Taxpayers Association, March 28, 2016

Email interview with Kaitlin Barker, spokeswoman for Nevada Secretary of State, March 28, 2016

Email interview with Jeremy Hughes, campaign spokesman for Michael Roberson For Congress, March 25, 2016

Associated Press, "State Senate hopeful says rival's flier misleads on tax vote," March 17, 2016

YouTube, "NV03 GOP Primary Debate pt 2," March 7, 2016

Las Vegas Sun, "Opponents of Nevada tax increase forging ahead in repeal effort," Jan. 29, 2016

Tax Foundation, "Nevada Approves New Tax on Business Gross Receipts," June 8, 2015

Nevada Business, "SB 483: The Facts You Need," July 1, 2015

Las Vegas Review-Journal, "Nevada Legislature OKs record budget, adjourns," June 1, 2015

Guinn Center for Policy Priorities, "Summary of Nevada Tax Proposals," April 21, 2015

Committee Meeting Exhibit, "Tax Policy for a New Nevada: Assembly Bill 464," April 17, 2015

Committee Meeting Exhibit, "MBT Nonfinancial Actual Data for FY04 - FY14" March 28, 2015

Nevada Appeal, "State of the State: Gov. Brian Sandoval calls for $1.1 billion in additional revenue," Jan. 16, 2015

Las Vegas Sun, "Some Nevada lawmakers want to keep 2009 tax increase from expiring," Feb. 12, 2013

Las Vegas Sun, "Bill Raggio: Sunsets on taxes are for a reason," April 20, 2011

Las Vegas Sun, "In a reversal, Sandoval to consider extending 2009 tax increases," May 26, 2011

Nevada Policy Research Institute, "The end-game: Part II," May 24, 2011

The Wall Street Journal, "Nevada in Budget Squeeze," Feb. 22, 2010

Las Vegas Sun, "Republicans take the pot in final hand," May 23, 2009

Reno Gazette-Journal, "Nevada tax panel can solve flap over payroll levy," July 30, 2003

Reno Gazette-Journal, "2003 Nevada Legislature: State Budget Battle," July 27, 2003

In a world of wild talk and fake news, help us stand up for the facts.