Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

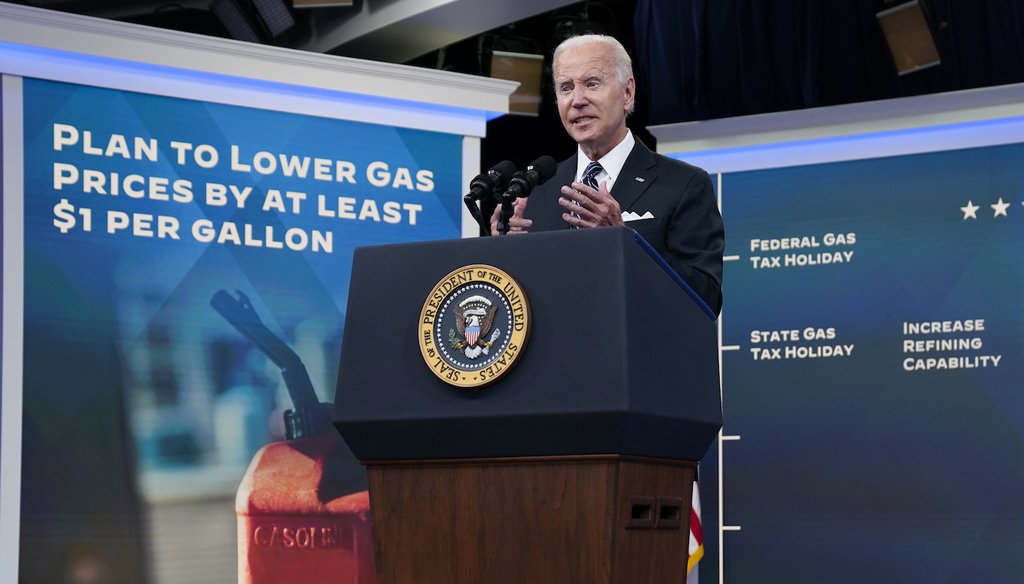

President Joe Biden speaks on gas prices at the White House on June 22, 2022. (AP)

If Your Time is short

-

President Joe Biden has urged Congress and states to stop collecting the gas tax temporarily.

-

However, economists warn that the benefits of a gas tax holiday are small and short-term, and that they would be outweighed by increased inflationary pressures and delays for infrastructure projects funded by the gas tax.

-

To enact a gas-tax holiday, Biden needs Congress to act. But both Republicans and Democrats have expressed doubts.

Seeking to address record-high gas prices nationwide, President Joe Biden has called on Congress and states to enact gas tax holidays.

In remarks on June 22, Biden called on Congress to suspend the federal gas tax for 90 days. Such a move would reduce prices at the pump by 18 cents per gallon on gasoline and 24 cents per gallon on diesel. At the time of his remarks, gasoline prices were hovering around $5 a gallon.

Patrick De Haan, the head of petroleum analysis at GasBuddy, estimated that a three-month tax holiday would save owners of a pickup truck $66.24 and owners of a compact car $26.52, with savings for such vehicles such as SUVs, minivans, and full-size cars falling between those figures.

Biden also urged states to follow suit by pausing their own gas taxes, which range from 15 cents a gallon to 68 cents, depending on the state.

Biden said he knows this won't lower gas prices by as much as Americans would like, but he asked Congress to act because "it will provide families some immediate relief, just a little bit of breathing room, as we continue working to bring down prices for the long haul."

Feedback from leaders in both parties was less than enthusiastic. The second-ranking Senate Republican, John Thune of South Dakota, said the proposal "is dead on arrival" in his chamber while House Speaker Nancy Pelosi, D-Calif., released a statement neither applauding nor condemning the tax pause. Sen. Tom Carper, D-Del., tweeted that Biden should "explore other options."

Meanwhile, a chorus of quick criticism came from a broad spectrum of economists. The benefits of a tax holiday would be small, they said, and would not necessarily flow to consumers.

"For a 10-gallon fill-up, that's $1.84 saved," said Clark Williams-Derry, an energy finance analyst with the Institute for Energy Economics and Financial Analysis. "That’s not nothing, but also not much of a dent in a family budget. And it doesn't even bring gas prices down to where they were a month ago."

Calling it a "a terrible idea," Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center, wrote that the policy would promote several undesirable consequences.

Some examples:

Increased consumption at a time of low supply. This could ultimately increase prices.

If you lower the relative price of gasoline, people are more likely to drive more, although exactly how much is hard to predict, said Alex Muresianu, a federal policy analyst for the Tax Foundation.

And since refineries "are operating at more than 95% of capacity, an increase in demand that could be brought about by a reduction in price will not necessarily be met by an increase in supply," said Hugh Daigle, an associate professor in petroleum and geosystems engineering at the University of Texas at Austin. "So, in fact, gasoline prices could actually rise, counterintuitively."

This price increase could "ripple through the rest of the economy" because the cost of gasoline factors into the price of many other products, said Marc Goldwein, senior vice president of the Committee for a Responsible Federal Budget.

And rather than the savings going to consumers, it could potentially boost the bottom line of the oil industry. There is no mechanism in place to prevent the companies from taking a share of the savings, Gleckman wrote.

Some highway projects depend on funding from gasoline tax revenues. A tax holiday could interrupt that work.

A gas tax holiday could reduce federal revenues by billions of dollars. While Biden has called on Congress to find other sources of revenue to fill the hole in the Highway Trust Fund, this could require an increase in federal borrowing, which would add to federal interest costs. It would also come at a bad time, as infrastructure improvements are part of the solution to the supply-chain problems that are driving overall inflation, Gleckman wrote.

It could dampen incentives for consumers to conserve gasoline.

While painful in the short term, higher gas prices can have the silver lining of promoting positive behaviors. Gleckman wrote that according to some studies, for every dollar increase in gasoline prices, spending on gasoline falls by between 27% and 37%, mostly through a reduction in miles driven. This can reduce carbon emissions and give consumers another reason to choose vehicles with energy efficiency in mind.

Given such tradeoffs, "economically, I don’t think there’s a lot of good arguments" for a federal gas tax holiday, Muresianu said.

The cost-benefit analysis for state gas tax holidays are a bit different because state taxes on gasoline tend to be higher, and therefore would be expected to produce more of a direct payoff.

If states follow a federal gas tax holiday, "it’s not impossible that some states could see fuel prices $1 a gallon lower than their 2022 peak, with wholesale prices also declining recently," De Haan tweeted.

Some states have already experimented with gas tax holidays. Maryland imposed a temporary gas tax holiday in March, which cut 36.1 cents per gallon on gasoline and 36.85 cents per gallon on diesel. Georgia also imposed a gas tax holiday, lifting a 29 cent tax on motor fuel and 32.6 cent tax on diesel fuel.

"A state-level gas tax holiday would have a larger effect on gas prices than a federal tax holiday almost everywhere," Daigle said. However, he said, a larger savings on price would spike the increase in gasoline consumption, and in turn, increase the impact on inflation.

And as with the federal gas tax, not all the benefits would necessarily flow to consumers. A Penn Wharton analysis found that the tax cut lowered gas prices for Maryland drivers by an average of 26 cents, with about one-third of the savings going elsewhere, including the oil industry.

The reality, experts said, is that Biden (and Congress) have few levers to affect the price of gasoline.

"U.S. oil and gasoline prices are set by markets, not by politicians," Williams-Derry said. "When Congress ended the oil export ban in 2015, we essentially fully integrated our oil markets with the global market, meaning that decisions by hostile foreign powers have immediate and direct effect on U.S. fuel markets."

The Biden administration has already tried or proposed a few of the levers at its disposal, including releasing oil from the Strategic Petroleum Reserve, expanding oil leasing on federal lands, and implementing a gas tax holiday, Williams-Derry said.

Another option would be to encourage more oil production, including through fracking, which might provide the fastest turnaround, Goldwein said. But increasing oil production runs counter to Biden's campaign promises to transition to clean energy.

Biden is also engaged in diplomacy. His upcoming trip to Saudi Arabia could result in increased production, which could help lower world crude oil prices, Finley said. In addition, "diplomatic outreach to China could result in more refinery processing for the global market, which could help ease the tight global refining situation," he said.

Longer-term initiatives to encourage energy diversification are also worth exploring, even if they can’t change the immediate gas price spike, Daigle said. "This could include things like extending or increasing tax breaks for electrical vehicle purchases and building out car-charging infrastructure," Daigle said.

Meanwhile, Goldwein said that Biden could use his bully pulpit to encourage Americans to drive less, including working more from home, as the pandemic has shown is feasible for many workers. States could also temporarily subsidize mass transit costs, he said.

"You can’t get from $5 gas to $4 gas this way," he said. "But neither would a gas tax holiday."

Our Sources

PBS NewsHour live stream, "President Joe Biden calls on Congress to pass gas tax suspension," June 22, 2022

White House, "Fact Sheet: President Biden Calls for a Three-Month Federal Gas Tax Holiday," June 22, 2022

AAA Gas Prices, accessed June 22, 2022

Penn Wharton Budget Model, "Effects of a Federal Gas Tax Holiday," March 11, 2022

Penn Wharton Budget Model, "Effects of a State Gasoline Tax Holiday," June 15, 2022

Howard Gleckman, "A Federal Gas Tax Holiday Is A Terrible Idea," June 22, 2022

Committee for a Responsible Federal Budget, "Gas Tax Holiday Would Cost $20 Billion," Feb. 10, 2022

NBC News, "Maryland, Georgia announce gas tax holidays as federal efforts stall in Congress," March 18, 2022

Reuters, "U.S. Senate's no. 2 Republican says gas tax holiday 'dead on arrival,'" June 22, 2022

Press release, "Pelosi Statement on President Biden’s Gas Tax Suspension Proposal," June 22, 2022

Twitter, @SenatorCarper, June 21, 2022

Patrick De Haan, tweet, June 22, 2022

NPR, "Biden plans a major withdrawal from the country's oil reserves to control gas prices," March 31, 2022

E&E News, "Biden admin restarts oil leases on federal land," April 15, 2022

White House, "Executive Order on Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis," Jan. 20, 2021

Email interview with Mark Finley, fellow in energy and global oil at the Center for Energy Studies, June 22, 2022

Interview with Marc Goldwein, senior vice president and senior policy director with the Committee for a Responsible Federal Budget, June 22, 2022

Interview with Alex Muresianu, federal policy analyst for the Tax Foundation, June 22, 2022

Email interview with Patrick De Haan, head of petroleum analysis at GasBuddy, June 22, 2022

Email interview with Hugh Daigle, associate professor in petroleum and geosystems engineering at the University of Texas-Austin, June 22, 2022

Email interview with Clark Williams-Derry, energy finance analyst at the Institute for Energy Economics and Financial Analysis, June 22, 2022