Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

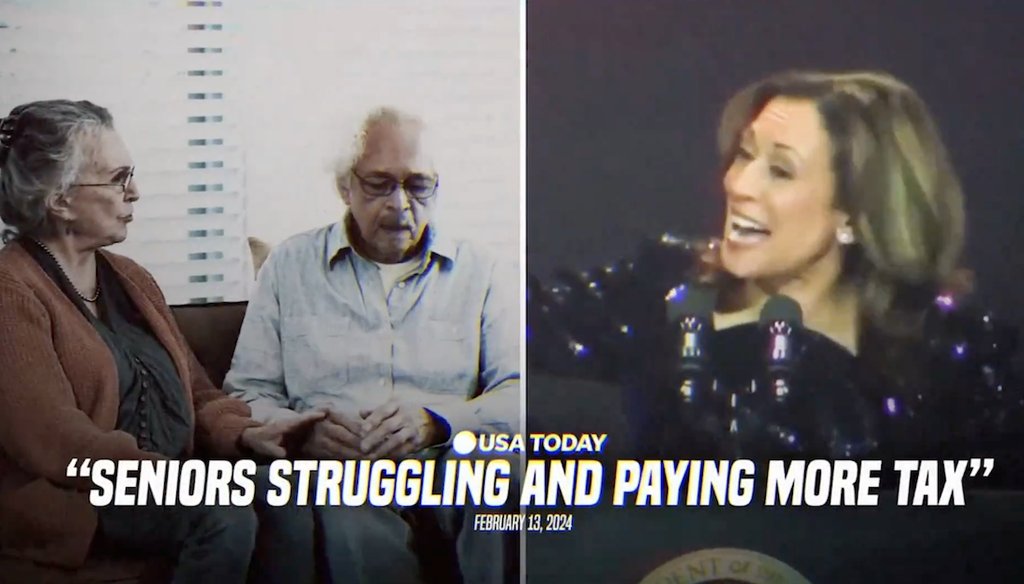

A screenshot from a Donald Trump ad taking issue with Kamala Harris over Social Security.

Vice President Kamala Harris has not proposed raising Social Security taxes for older Americans. Rather, she has proposed lifting the payroll income tax cap beyond which the government stops taxing workers.

The people who would pay higher taxes under Harris’ proposal are neither older nor struggling. They’re workers who benefit from the current cap that applies only to higher-income taxpayers.

Harris said in 2019 that she would like to see immigrants in the U.S. illegally qualify for universal health coverage. She has not repeated that since becoming the vice president or the presidential nominee.

One of former President Donald Trump’s closing ads in the 2024 presidential race accuses Vice President Kamala Harris of wanting to raise taxes on older Americans while giving Social Security and Medicare benefits to immigrants in the U.S. illegally.

Harris "wants struggling seniors to pay more Social Security taxes while she gives Medicare and Social Security to illegals," the narrator says in the ad, released Oct. 17.

The ad is inaccurate. Harris has not proposed raising Social Security taxes for older Americans; she has proposed lifting the income cap beyond which the government stops taxing workers.

In a statement to PolitiFact, the Trump campaign cited the Harris campaign’s support for eliminating the payroll tax cap.

But as support for the ad’s claim, this is nonsensical.

Harris proposes eliminating the payroll tax income cutoff beyond which the government stops taxing workers. Payroll tax revenue is earmarked to support Social Security and Medicare. For 2024, any payroll income higher than $168,600 is not taxed; this threshold is set to rise in future years depending on inflation.

Under the current policy, wealthier taxpayers get a break on payroll taxes, while taxpayers with low or moderate incomes pay full freight. Harris proposes to change this by imposing payroll taxes above the current income threshold.

Although the ad says Harris "wants struggling seniors to pay more Social Security taxes," the people who would pay more under Harris’ proposal would be neither older Americans nor struggling. They’re working-age taxpayers who earn at least $168,600. For comparison, the median annual pay for a full-time U.S. worker is $60,580.

In the ad, the text on screen cites a different piece of evidence. The ad cites a February 2024 USA Today article and shows a portion of the article’s headline that says, "Social Security 2025 COLA seen falling, leaving seniors struggling and paying more tax." (COLA stands for cost-of-living adjustment.)

But this doesn’t support the ad’s claim, either.

The USA Today article reported that an independent advocacy group, the Senior Citizens League, was projecting that the annual cost of living adjustment for Social Security benefits — an adjustment required under law to allow beneficiaries’ incomes to keep pace with inflation — would be 1.75% in 2024, well below what the group predicted inflation would be.

But the Senior Citizens League was making a prediction — that proved to be wrong. The Social Security Administration subsequently announced a 2.5% cost of living increase, which is roughly in line with current year-over-year inflation of 2.4%.

The cost-of-living increase argument "isn’t evidence that Harris wants seniors to pay more in tax on Social Security benefits," said Garrett Watson, senior policy analyst at the Tax Foundation, a center-right think tank.

It’s possible to argue that Trump’s promise to end taxation of Social Security benefits means that Social Security beneficiaries would pay more in taxes under Harris than they would under Trump, Watson said.

But he added that the ad didn’t say that. "The claim itself implies Harris supports higher tax rates on those benefits than under current law, which isn’t accurate," Watson said.

Immigrants in the U.S. illegally currently aren't eligible for Social Security and Medicare. And Harris hasn’t proposed changing that during this campaign.

The Trump campaign pointed us to comments from Harris’ 2019 presidential campaign, in which she expressed a willingness to include immigrants in the U.S. illegally to qualify for universal health care.

Since she’s been vice president and the presidential nominee, Harris hasn’t expressed similar views.

Harris has spoken about a pathway to citizenship that would enable at least some people in the U.S. illegally to qualify for Medicare and Social Security eventually, but it would take years. Harris hasn’t detailed a pathway to citizenship plan.

People who are legally allowed to work in the U.S. can receive Social Security retirement benefits, but only after they’ve worked and paid Social Security taxes for 10 years.

A Trump ad said Harris "wants struggling seniors to pay more Social Security taxes while she gives Medicare and Social Security to illegals."

Harris did not propose raising Social Security taxes for older Americans. Rather, she has proposed lifting the payroll income tax cap beyond which the government stops taxing workers. People who would see higher taxes as a result are neither older nor struggling. They’re workers who make at least $168,000 annually.

As a Democratic primary candidate in 2019, Harris said she would like to see people in the U.S. illegally qualify for universal health coverage, but she has not said that since becoming vice president or the presidential nominee.

We rate the statement False.

Donald Trump, campaign ad, Oct. 17, 2024

USA Today, "Social Security 2025 COLA seen falling, leaving seniors struggling and paying more tax," Feb. 13, 2024

Social Security Administration, "Cost-Of-Living Adjustments," accessed Oct. 22, 2024

Federal Reserve Bank of Minneapolis, "Consumer Price Index, 1913- ," accessed Oct. 22, 2024

Internal Revenue Service, "Social Security and Medicare withholding rates," accessed Oct. 22, 2024

Federal Reserve Bank of St. Louis, "Employed full time: Median usual weekly nominal earnings (second quartile): Wage and salary workers: 16 years and over," accessed Oct. 22, 2024

Tax Foundation, "Exempting Social Security Benefits from Income Tax Is Unsound and Fiscally Irresponsible," August 2, 2024

National Review, "Kamala Harris Backs Publicly Funded Health Care for Illegal Immigrants," Aug. 11, 2020

YouTube, "Democratic Presidential Debate - June 27, 2019"

House Republican Conference, X post, July 24, 2024

PolitiFact, "How Donald Trump and Kamala Harris want to change your taxes," Oct. 9, 2024

PolitiFact, "Donald Trump ad makes False claims about Kamala Harris, immigration, Social Security," Sept. 18, 2024

Email interview with Juliette Cubanski, deputy director of the Program on Medicare Policy at KFF, Oct. 21, 2024

Email interview with Eugene Steuerle, fellow at the Urban Institute, Oct. 21, 2024

Email interview with Garrett Watson, senior policy analyst at the Tax Foundation, Oct. 21, 2024

Statement from the Harris campaign, Oct. 22, 2024

Statement from the Trump campaign, Oct. 22, 2024

In a world of wild talk and fake news, help us stand up for the facts.