Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

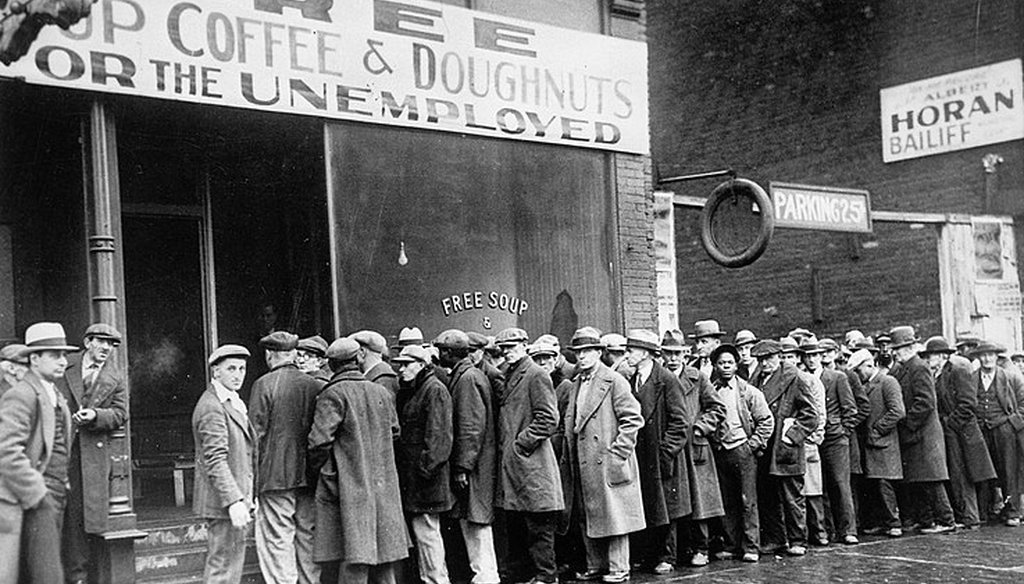

Unemployed men line up outside a depression soup kitchen in Chicago. (National Archives/Public domain)

• The claim uses 1930 income figures that captured only the richest 10% or so of Americans, which skews the comparison with typical incomes from the entire population today.

• One federal statistic that the claim ignores is personal disposable income per capita. After accounting for inflation, income under this measurement is now more than six times higher than it was in 1930.

• Economists say that the scale of deprivation during the Great Depression was vastly greater than today’s economy.

If you listen to some TikTok influencers and personalities, you might have heard that the current U.S. economy is bad. Really bad. Worse-than-the-Great-Depression bad.

Isabel Brown, a content creator for conservative groups including Turning Point USA, PragerU and Students For Trump, laid out the case in an Aug. 23 TikTok that drew more than 100,000 likes, saying Americans "are currently making less than at the height of the Great Depression."

But we found this is based on a flawed methodology and a misunderstanding of the scale of deprivation during the Great Depression.

Brown did not respond to PolitiFact’s inquiries sent to her website and Instagram account.

First, a word about the Great Depression.

It started with the 1929 stock market crash and quickly became an international economic contagion, lasting through most of the 1930s.

In 1933, unemployment was about 25% — compared with 3.8% today — and wages for workers who managed to keep their jobs fell by nearly 43% between 1929 and 1933, according to the Franklin D. Roosevelt Presidential Library. Industrial production fell by nearly half, and gross domestic product, a measure of the economy as a whole, fell by 30%. Nearly a third of the nation’s banks failed between 1930 and 1933.

Farm prices declined so precipitously that many farmers lost their land and homes, and families in rural and urban areas alike faced malnutrition, or even starvation. The economic pain was so severe that families desperately relocated to other states in search of jobs, or lived in "Hoovervilles," collections of shanties across the U.S. that were named after the president at the time, Herbert Hoover.

It was, according to former Federal Reserve historian Gary Richardson, "the longest and deepest downturn in the history of the United States and the modern industrial economy."

Although the 2020 recession produced an almost depression-like contraction, with unemployment spiking at about 14%, the pain was comparatively brief, dropping by almost half within six months, to about 6% within a year, and to its pre-pandemic level within two years.

In other words, the widespread hardship experienced during the Great Depression dwarfs economic hardships that exist today.

Brown began her claim by playing a clip from another TikTok video whose narrator used a term Brown said "made me stop in my tracks."

"This guy believes we’re not just living in worse than the Great Depression," she said. "We’re living in the ‘silent depression.’"

Brown first turned to U.S. income. "The average annual income in 1930 for an American individual was a little over $4,800. Sounds like nothing, but if you adjust that for inflation, a little over $4,800 a year in 1930 is equivalent to almost $85,000 annually for the average salary for one person right now. (But today) the average annual salary is $56,000 a year. We currently are making less than the height of the Great Depression."

For 1930 income, Brown cited the "average net yearly income of Americans," according to a federal internal revenue report for 1930, which she said worked out to $4,887.01.

But this number doesn’t represent the income of all Americans, or even close to it, because the reach of the agency known today as the Internal Revenue Service wasn’t wide in 1930.

According to an IRS report for the 1930 tax year, the agency accepted 3.7 million tax returns, at a time when U.S. households numbered roughly 30 million, making the share of the population filing tax returns about 10%. (In 1940, the earliest year for which we could find data on households, the U.S. had 34.9 million households, so we used 30 million as an estimate for 1930.)

Why does this matter? Because the $4,887.01 figure Brown uses represents not the "average net yearly income of Americans," but rather the average net yearly income of the one-tenth of Americans who were rich enough to be required to file a tax return.

Once this figure becomes the baseline for inflation adjustments, economists say, the comparison is so skewed that it becomes meaningless. The average annual income that Brown cites for the present day — $56,000 — includes all Americans, so it’s not surprising that the 1930 income figure from the highest earners outpaces the all-incomes figure for today after adjusting for inflation.

She "couldn’t have gone to a worse place" for her data on 1930s income, said Douglas Holtz-Eakin, president of the American Action Forum, a center-right think tank in Washington, D.C. After that, Holtz-Eakin said, a botched comparison was "unavoidable."

There is a measure by which an apples-to-apples comparison can be made: personal disposable income per capita. This statistic, calculated by the federal Bureau of Economic Analysis, measures all personal income earned by Americans, minus taxes, divided by population.

In raw dollars, personal disposable income per capita grew from $609 in 1930 to $55,698 in 2022. Once that’s adjusted for inflation, it rose from $6,836 in 1930 to $45,343 in 2022. That’s about 6.7 times higher than it was in 1930, all of which is growth beyond the inflation rate.

"Have average real U.S. incomes improved or declined since 1930? Answer: They have improved — and substantially," said Gary Burtless, an economist with the Brookings Institution, a Washington, D.C. think tank.

Brown said Americans "currently are making less than at the height of the Great Depression."

The 1930 income figure she cited accounts only for approximately the richest 10% of the U.S. population at the time, making a comparison with the population at large today meaningless.

An apples-to-apples comparison shows that, even after accounting for inflation, personal disposable income per capita is more than six times higher today than it was in 1930.

The claim that American incomes are lower now than during the Great Depression — the longest, deepest economic downturn in U.S. history — is false and ridiculous. Pants on Fire!

Isabel Brown, TikTok post, Aug. 23, 2023

Internal Revenue Service, Statistics of Income, 1930

Internal Revenue Service, "Internal Revenue Service Return Preparer Review," December 2009

U.S. Census Bureau, "Table HH-1: Households by Type: 1940 to Present," accessed Sept. 5, 2023

Federal Reserve Bank of St. Louis, "Real Disposable Personal Income: Per Capita," accessed Sept. 5, 2023

Bureau of Labor Statistics inflation calculator, accessed Sept. 5, 2023

Email interview with Gavin Wright, economic historian emeritus at Stanford University, Sept. 5, 2023

Email interview with Claudia Goldin, economist at Harvard University, Sept. 5, 2023

Email interview with Paul W. Rhode, economist at the University of Michigan, Sept. 5, 2023

Email interview with Steve Fazzari, economist at Washington University in St. LouIs, Sept. 5, 2023

Email interview with Dean Baker, co-founder of the Center for Economic and Policy Research, Sept. 5, 2023

Email interview with Gary Burtless, senior fellow with the Brookings Institution, Sept. 5, 2023

Interview with Douglas Holtz-Eakin, president of the American Action Forum, Sept. 5, 2023

In a world of wild talk and fake news, help us stand up for the facts.