Get PolitiFact in your inbox.

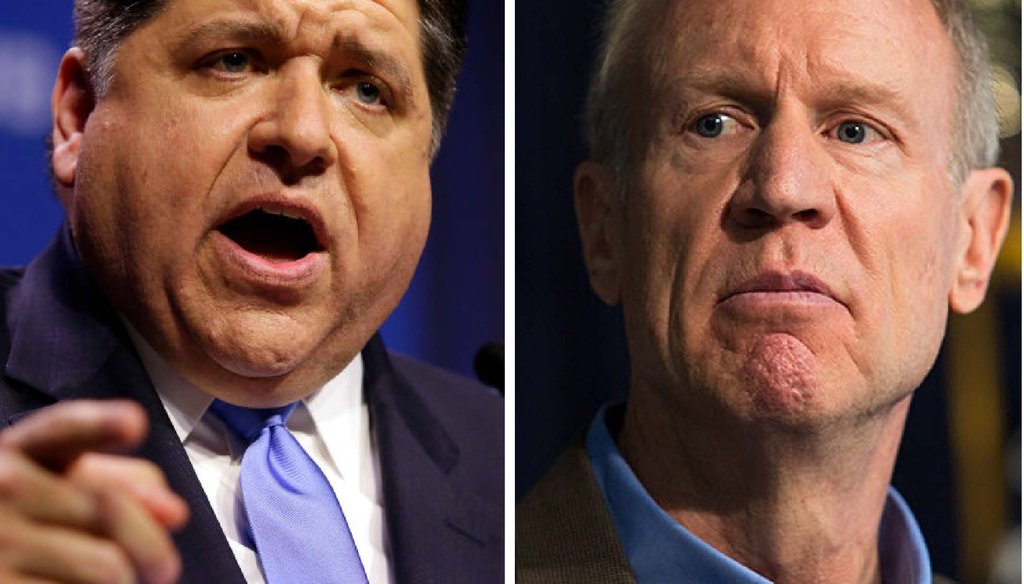

Pritzker: Joshua Lott/Getty Images; Rauner: Lou Foglia/Sun-Times

It should be no surprise to anyone keeping tabs on Illinois government dysfunction that a history-making, two-year budget impasse dug state finances, already in a hole, into a far deeper one.

Just how deep, and whose fingerprints are on the shovel, are questions that almost surely will be intensely debated in the runup to the November election.

Newly anointed Democratic nominee for governor J.B. Pritzker wasted little time recently seizing on dire-sounding numbers in a new report stamped by the Illinois Auditor General.

"Rauner Deficit Increased 52% in FY17 to $14.6 Billion," Pritzker’s campaign proclaimed in a news release that squarely blamed the development on Republican Gov. Bruce Rauner, something the report did not assert.

Expect to hear more of this as campaign season drags on, though the numbers and alleged culprits will vary depending on political agendas.

Sign up for PolitiFact texts

Meanwhile, a report from the Illinois State Comptroller shows the state’s main checking account ended the last fiscal year $8 billion in the red. And Rauner often complains that Democratic lawmakers passed a budget over his veto last summer that is at least $1 billion out of balance.

$14.6 billion? $8 billion? $1 billion? How to make sense of all those conflicting fiscal yardsticks?

For the layman voter, there may be no practical need to fathom the difference, says University of Illinois Springfield budget expert Charles N. Wheeler III. "In a way, it doesn’t really make much difference: we’re so far in the hole," said Wheeler, a former Illinois statehouse reporter who now heads the school’s Public Affairs Reporting Program.

But as the campaign season wears on, attack ads and political speeches will fill the airwaves with a dizzying array of data points all meant to dirty the hands of each candidate’s opponents in painting what amounts to the same glum picture of a state in fiscal peril.

Here’s a primer on what the different numbers actually mean:

A question of magnitude

The deficit figure that Pritzker’s release draws upon is calculated according to a set of accounting principles accepted as the gold standard among auditors.

By that metric, the balance of Illinois’ general fund -- which pays for many key state services, including education and health care -- plummeted just over $5 billion between 2016 and 2017, growing the deficit from a merely jaw-dropping $9.6 billion to a truly horrendous $14.6 billion during that time.

But that measure is just one of several figures politicians can turn to for ammunition when seeking to blast opponents for fiscal irresponsibility as Illinois lurches toward a general election sure to center on the state’s perilous fiscal status.

According to a different budgetary measure more commonly used by lawmakers, lobbyists and others plugged in to the state’s day-to-day operations, the deficit increase looks even worse.

A recent report from the state Comptroller shows the state ended fiscal year 2017 with a negative balance of nearly $8 billion in its main account. That’s a smaller number than the one cited by Pritzker, but it’s more than double the size of the deficit as reported by the Comptroller under the comparable metric at the close of fiscal 2016. What’s more, available data going back to at least 1990 show the end-of-year cash balance has never been as bad.

The difference in the two numbers can be explained this way: The $8 billion deficit figure represents the imbalance of revenues flowing into the fund with spending flowing out of it. The nearly $15 billion figure takes that into account as well as money owed to and by the state, which, thanks to the budget impasse, built up a huge backlog of unpaid bills.

Technical distinctions aside, however, the two numbers say much the same thing: the state is failing to keep its financial house in order--and, as a survey of previous annual balances underscores, has failed to do so for a long time.

And those figures are not to confused with a different one sometimes stirred into the deficit stew: the projected balance on the current fiscal year’s budget, which Democratic lawmakers passed in July over Rauner’s veto with the help of a handful of Republicans.

In September, Rauner lambasted the Democrats’ budget for being more than $1 billion in the red even after lawmakers, again over his veto, hiked the state income tax to raise an additional $5 billion a year in revenue.

At the time, we examined the governor’s claim and rated it Mostly True, even though Democrats contended their budget would actually show a modest surplus.

Pointing fingers

One reason for the disconnect is that the Illinois Constitution requires budgets to be in balance or better when passed, so state politicians of both parties have proved adept over the years in resorting to fiscal gimmicks that give the appearance of balance on paper without the reality.

"It’s a number that seems to be a fantasy based on past history," said David Merriman, director of the Fiscal Futures Project at the University of Illinois’ Institute of Government & Public Affairs.

"We’re supposed to show that funds are available for the expenditures that we make, so it’s completely bizarre that we can have large deficits," Merriman said, noting that available funds haven’t matched spending for almost two decades.

This shared legacy of fiscal sleight-of-hand hasn’t stopped politicians from accusing each other of sinking the state’s financial ship.

Pritzker’s recent campaign release, for instance, attempts to hang the deficit and its growth during the budget impasse directly around the governor’s neck.

Over that two-year period, Illinois ran largely on autopilot as Rauner and Democratic leadership tussled over a spending plan and allowed a temporary income tax increase to expire, racking up bills and further burdening a state already teetering on the edge of a fiscal cliff.

But Merriman says there’s plenty of blame to go around.

"Nobody running in the Democratic party, nobody running in the Republican party … has come anywhere near grappling with what the real situation is," he said, noting the only way out of the state’s entrenched fiscal morass is a politically untenable combination of sustained cuts tax increases.

"When the governor says we’re a billion dollars out of balance," Merriman said, "You think ‘ha, if only!’ If we were a billion dollars out of balance, I’d be whooping with joy."

Our Sources

News release, J.B. Pritzker campaign, March 23, 2018

Summary Report Digest, Illinois Auditor General, March 22, 2018

Comprehensive Annual Financial Report (Fiscal Year 2017), Illinois Comptroller

Traditional Budgetary Report (Fiscal Year 2017), Illinois Comptroller

Email interview, Jordan Abudayyeh, Pritzker campaign spokeswoman, March 28, 2018

Phone and email interview, Charles N. Wheeler III, University of Illinois at Springfield, March 27, 2018

Rauner's right: Illinois budget balancing act an ongoing production, PolitiFact Illinois, Sept. 20, 2017

FY 2018 Economic Forecast and Revenue Estimate and FY 2017 Revenue Update, Commission on Government Forecasting and Accountability, March 7, 2017

Phone interview, David Merriman, University of Illinois Chicago, March 29, 2018