Raise corporate tax rate to 28%

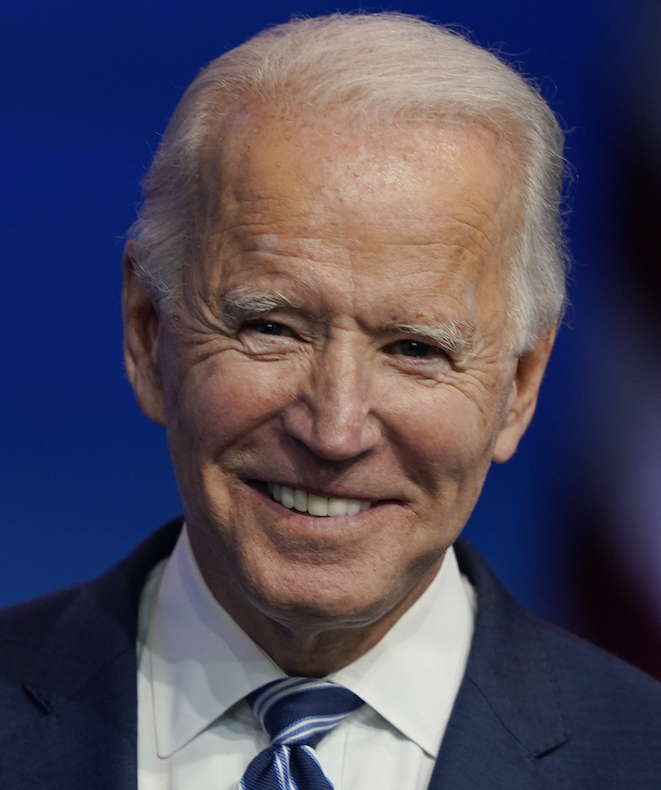

Joe Biden

"He will ask wealthy Americans and big corporations to pay their fair share, including by: Raising the corporate tax rate to 28%."

Biden Promise Tracker

Compromise