No tax increase for anyone making less than $400,000

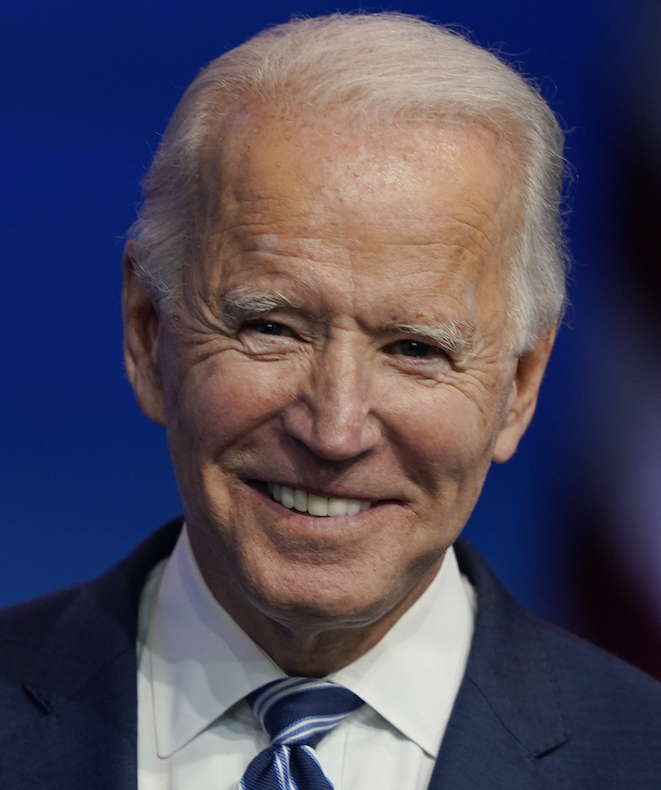

Joe Biden

"Under my plan, if you make less than $400,000, you won’t pay a single penny, more in taxes. You have my word on it."

Biden Promise Tracker

Promise Kept