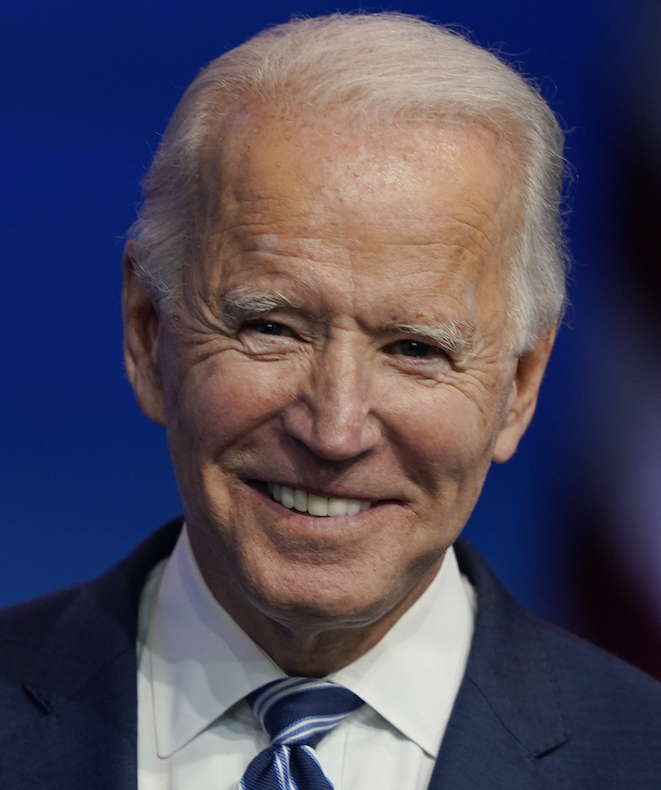

As a candidate in 2020, President Joe Biden promised to put Social Security on a path to solvency. But in his 2024 reelection campaign, Biden has challenged any discussion by Republicans of cutting benefits or raising the retirement age, two of the most commonly discussed policies to extend the program's solvency.

Social Security's fiscal concerns stand to worsen without big changes. Already, the program's trust fund is projected to run dry in about a decade, which would prompt large-scale cuts across the board.

"If anyone tries to cut Social Security, we're going to stop it," Biden said Feb. 9, 2023, in Tampa, Florida. Referring to a high-profile faceoff he had with Republican lawmakers during the 2023 State of the Union address, Biden said, "Sounded like they agreed to take these cuts off the table. I sure hope so. I really mean it."

More recently, Biden has used the Social Security discussion to hammer his presumptive 2024 opponent, former President Donald Trump. Biden pounced when Trump told CNBC on March 11 that "there is a lot you can do in terms of entitlements in terms of cutting." (Trump quickly walked back his comments.)

Biden, speaking in New Hampshire shortly after Trump's comments were aired, said, "If anyone tries to cut Social Security or Medicare, or raise the retirement age again, I will stop them."

However, keeping the status quo jeopardizes the program fiscally, experts said.

"Congress and the president don't even want to discuss the issue. But a day of reckoning is coming," said Eugene Steuerle, a fellow at the Urban Institute, a Washington, D.C., think tank. "Revenues are inadequate to pay current bills, much less bills that rise as a share of national income."

Biden's fiscal year 2025 budget, released March 12, reiterated his opposition to cutting benefits or raising the retirement age. The budget backed "extending solvency" for the program by ensuring that higher-income Americans pay Social Security taxes on all of their earnings, which they currently do not.

That might help Social Security's fiscal position somewhat, but the budget provided little detail on how this tax increase would be structured. Presidential budgets are considered dead on arrival in Congress, especially when the opposite party controls at least one of the chambers, as the Republicans do now in the House.

"Like a car accelerating down a hill toward a barrier, the Biden proposals basically would move back the barrier a bit, only delaying the reckoning that is required," Steuerle said.

It's getting late in Biden's term to enact policies that would significantly extend Social Security's actuarial life, and the president has forcefully and repeatedly ruled out two potential options, benefit cuts and a higher retirement age. We rate this promise Stalled.