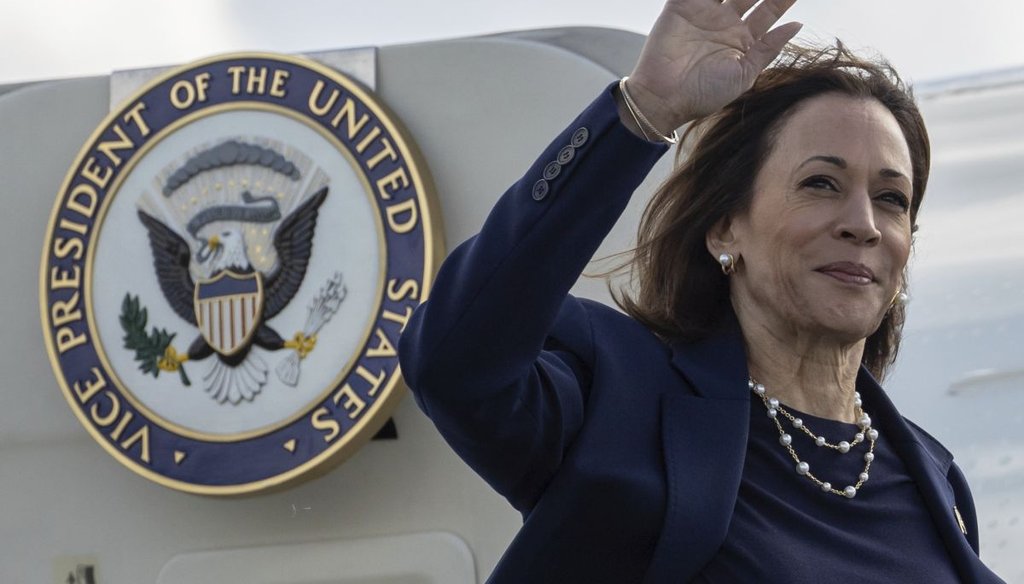

Vice President Kamala Harris waves as she boards Air Force Two at LaGuardia International Airport in New York on Oct. 9, 2024. (AP)

Under current law, the 25 highest-earning billionaires paid a 16% tax rate on average, estimates show, while the top 1% of taxpayers paid an average rate north of 25.6%.

More than 91% of households earning from $50,000 to $100,000 a year — the category that includes most teachers, firefighters and nurses — paid effective tax rates of 15% or less, often much less.

One study of 342 U.S. corporations found they pay an effective tax rate of 14.1%, which is a higher rate than most, though not all, middle-income households pay.

During her "60 Minutes" interview, Vice President Kamala Harris resurrected an old talking point to justify raising taxes on the wealthiest Americans.

CBS News’ Bill Whitaker pressed Harris on how she would pay for promises such as an expanded child tax credit and aid to small-business startups. Harris pointed to her plan to raise taxes on wealthier taxpayers.

"Well, one of the things is I'm gonna make sure that the richest among us, who can afford it, pay their fair share in taxes," Harris said in the Oct. 7 interview. "It is not right that teachers and nurses and firefighters are paying a higher tax rate than billionaires and the biggest corporations."

Harris made an almost identically worded remark the following day on CBS’ "The Late Show with Stephen Colbert."

In 2022 and 2023, we fact-checked similar statements by President Joe Biden and found them False.

Taxpayers may think of tax rates solely as the percentage of income they pay on their annual tax filings. But when Biden and Harris use this talking point, they are factoring in a Biden proposal to tax wealth held by the richest fraction of Americans, rather than just income.

In 2023, the White House published a fact sheet that said the average tax rate for billionaires is 8%. The White House’s 8% figure came from a report by its own Council of Economic Advisers that examined what would happen if the United States were to tax unrealized gains on stocks.

Currently, if people see their stock shares rise in value over time, they don’t pay taxes on those gains until they sell the shares. If the shares are never sold, they aren’t taxed. Under current law, stockholders may pass their shares to the next generation with little or no taxation.

Biden has sought without success to change that in Congress; Harris may do so, too. (She has spoken broadly about taxing billionaires, but has not specified this type of tax publicly.)

The White House report found that if you include unrealized gains in the income calculations of the 400 richest U.S. families, those families are ultimately paying a tax rate of 8.2%. However, 8% does not represent the standard tax rate billionaires pay today. It’s a theoretical calculation that would apply if the law is changed.

The real-life tax burden for the wealthiest Americans under the tax code exceeds 8%, and it makes a big difference in the comparison with teachers, nurses and firefighters.

IRS data from 2019 shows that the top 1% of taxpayers paid an average federal income tax rate of 25.6%. A more elite group, the top 0.001% — which in 2019 meant people earning about $60 million or more a year — paid 22.9%. (Data from 2020 are skewed by pandemic-era stimulus payments, and more recent data is not yet available.)

ProPublica, an investigative journalism outlet, looked at the tax burden of the 25 richest Americans, who account for about 2.5% of all U.S. billionaires. ProPublica found that the tax rate these 25 billionaires paid under current law is 16%.

About 41% of households paid zero or negative net federal individual income taxes in 2022 and 2023, according to estimates by the Urban Institute-Brookings Institution Tax Policy Center, a Washington D.C.-based think tank.

The average annual income without overtime for firefighters is $60,390, and $68,890 for K-12 teachers. For nurses, it’s $94,480.

More than 91% of households with adjusted gross incomes of $50,000 to $100,000 pay an effective tax rate ranging from 5% to 15%, the Tax Policy Center found.

If a teacher or a firefighter paid at the highest of these estimates — 15% — that would still be below the 16% the top 25 billionaires paid, and even further below what the top 1% paid.

Billionaires do find ways to avoid paying a lot in taxes.

"Higher earners can borrow on their unrealized gains for consumption, and then avoid taxes at death when passing along those assets," Garrett Watson, senior policy analyst with the Tax Foundation, a Washington, D.C.-based think tank, told PolitiFact in 2023.

This "buy-borrow-die" strategy allows the very richest Americans to avoid a large share of taxes they might otherwise have to pay.

However, Watson said this tactic "could be tackled more directly in the tax code without requiring a complicated minimum tax" such as the one Biden is proposing.

Harris also said the "biggest corporations" were also paying a lower rate than workers in common professions.

Corporations are officially taxed at 21%, but they can effectively lower their tax rate by using several legal maneuvers to shield the amount of their income subject to that tax rate.

The Institute on Taxation and Economic Policy, a liberal-leaning group, in a February 2024 analysis studied 342 large corporations that were profitable each year from 2018 to 2022. The group found they paid an average effective income tax rate of 14.1% over a five-year period.

That’s well below the statutory rate of 21%. However, it’s still a higher rate than that paid by two-thirds or more of taxpayers in the $50,000 to $100,000 income range.

Some of the biggest and most profitable companies did pay less than 5%, the study found. These include AT&T, Bank of America, Citigroup, Dish Network, FedEx, General Motors, Molson Coors, Netflix, Nike and T-Mobile. In 2021, the group found that "at least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite enjoying substantial pretax profits in the United States."

Harris said, "Teachers and nurses and firefighters are paying a higher tax rate than billionaires and the biggest corporations."

In the vast majority of cases, this is inaccurate.

Under current law, the 25 highest-earning billionaires paid a 16% tax rate on average, estimates show, while the top 1% of taxpayers paid an average rate more than 25%.

By contrast, more than 91% of households earning from $50,000 to $100,000 a year — the category that includes most teachers, firefighters and nurses — paid effective tax rates of 15% or less, often much less.

One study of 342 U.S. large, profitable corporations found they pay an effective tax rate of 14.1%, which is a higher rate than paid by most middle-income workers Harris referred to. Some of the biggest and most profitable companies, however, did pay tax rates of 5% or less.

We rate the statement Mostly False.

Kamala Harris, interview on "60 Minutes," Oct. 7, 2024

Kamala Harris, appearance on "The Late Show with Stephen Colbert," Oct. 8, 2024

White House, "What Is the Average Federal Individual Income Tax Rate on the Wealthiest Americans?" Sept. 23, 2021

White House, "Fact Sheet: The Biden Economic Plan Is Working," Feb. 6, 2023

Bureau of Labor Statistics, "National Occupational Employment and Wage Estimates," accessed Oct. 10, 2024

Tax Foundation, "Taxing Consumption Progressively Is a Better Way to Tax the Wealthy," June 8, 2021

Internal Revenue Service, "SOI Tax Stats - Individual statistical tables by size of adjusted gross income," accessed Oct. 10, 2024

Tax Foundation, "Summary of the Latest Federal Income Tax Data, 2023 Update," Jan. 26, 2023

Urban Institute-Brookings Institution Tax Policy Center, "T21-0161 - Tax Units with Zero or Negative Income Tax, 2011-2031," accessed Oct. 10, 2024

Urban Institute-Brookings Institution Tax Policy Center, "Effective Tax Rate by Size of Income," accessed Oct. 10, 2024

Institute for Taxation and Economic Policy, "New Study: Corporate Tax Avoidance Remains Widespread Under Trump Tax Law," Feb. 29, 2024

CNN, "Ignore social media. Here’s what Harris’ unrealized capital gains tax proposal means for you," Oct. 6, 2024

ProPublica, "The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax," June 8, 2021

PolitiFact, "Joe Biden miscalculates how much billionaires pay in taxes," Feb. 20, 2023

PolitiFact, "Joe Biden’s dubious math on the federal income tax burden," July 13, 2022

Email interview with Garrett Watson, senior policy analyst with the Tax Foundation, Oct. 7, 2024

In a world of wild talk and fake news, help us stand up for the facts.