Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

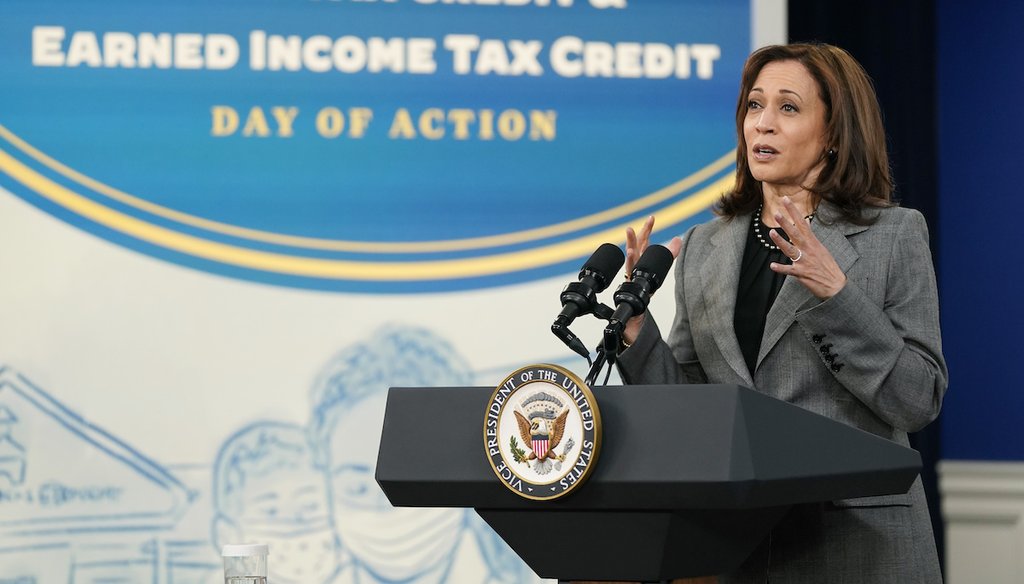

Vice President Kamala Harris delivers remarks encouraging Americans to take advantage of tax credits, including the expanded Child Tax Credit and Earned Income Tax Credit, at the White House on Feb. 8, 2022. (AP)

Kamala Harris has worked to expand the child tax credit, not end it, as JD Vance said

If Your Time is short

-

Vice President Kamala Harris has repeatedly expressed support for the child tax credit.

-

The Biden administration approved the 2021 American Rescue Plan, which expanded the child tax credit that year to $3,600 per child younger than 6, and $3,000 per child ages 6 to 17. The current amount is $2,000 per child, up to age 16.

-

The administration has pressured Congress to make the more generous credits permanent.

Republican vice presidential nominee JD Vance defended his past remarks about childless women by falsely claiming that Vice President Kamala Harris, the Democrats’ presumptive presidential nominee, wants to end a tax credit for parents.

Vance has gotten a lot of backlash about a pair of interviews he gave in 2021, one in which he complained the U.S was being run by "a bunch of childless cat ladies," and another in which he said childless Americans should pay higher tax rates. Vance has since told Sirius XM radio host Megyn Kelly and Fox News that his comments were taken out of context.

Then, the Ohio senator shifted to Harris.

"Why do we have the Harris campaign coming out this very morning, Megyn, and saying that we should not have the child tax credit, which lowers tax rates for parents of young children? It's because they have become antifamily and antikid," Vance told Kelly on July 26.

He followed up with the similar claim in a July 28 interview with Fox News host Trey Gowdy. "How did we get to this place where Kamala Harris is calling for an end to the child tax credit?" Vance said.

She isn’t. PolitiFact found no evidence that Harris has ever called to end the child tax credit. On the contrary, she supports it. The Biden-Harris administration expanded the tax credit in 2021, when the American Rescue Plan became law, and Harris has pushed Congress to make the credit permanent.

We contacted Vance’s Senate office and the Trump campaign for comment but did not hear back by publication.

Harris’ support of the child tax credit

Congress established the child tax credit in 1997 to financially support families with children. The amount and age of eligibility have been increased and expanded multiple times, with bipartisan support, since 2001.

The credit provides families up to $2,000 per child younger than 17. Taxpayers who don’t owe enough in taxes to benefit from the credit could receive a refund of up to $1,400, but not the full $2,000. Eligibility for the credit phases out at higher income levels — currently single filers making $200,000 a year or more, or $400,000 for joint filers.

The American Rescue Plan, which passed Congress with slim Democratic majorities before President Joe Biden signed it into law in March 2021, increased the credit for the 2021 filing year. The measure expanded the credit to $3,600 per child younger than 6, and $3,000 per child ages 6 to 17. The credit was also made fully refundable, making households eligible to receive the full benefit. (The credit reverted in 2022 to the previous $2,000-per-child maximum.)

Harris called the increased child tax credit "one of the most important, one of the most impactful parts of the American Rescue Plan."

The tax credit helped lift 2.9 million children out of poverty in 2021, a Census Bureau paper found. Almost three-quarters of the children benefited from the 2021 expansion, the report said.

The Biden administration has pushed to make the 2021 credit increase permanent, including it in the White House’s 2025 fiscal year budget blueprint. In January, Harris lauded the House for passing a bipartisan tax package that includes the child tax credit expansion.

"Good news: The Child Tax Credit bill is headed to the Senate," Harris posted Feb. 1 on X "While @POTUS and I continue to fight for the full expanded Child Tax Credit, this bill should be passed quickly. President Biden is ready to sign it into law."

The bill has languished in the Senate, where some Republicans oppose the measure without revisions that limit the credits’ parameters; they’re calling for eliminating a "look-back" policy that would let taxpayers use a previous year’s income if it yielded a larger child tax credit.

A Harris staff member's X post

Other Republicans on social media echoed Vance’s quip about Harris and the child tax credit. The chatter stems from a report by the Daily Caller, a conservative-leaning news outlet, about a Harris staff member’s criticism of Vance on X.

Before we explain further, no, a campaign staff member’s X post does not represent the presidential candidate’s policy. Here’s what happened.

Ammar Moussa, the Harris campaign’s rapid response director, criticized Vance’s past remarks on parents benefiting from tax policy.

Moussa shared an ABC News story about Vance’s 2021 remarks on "The Charlie Kirk Show" podcast. Vance said U.S. tax policy needed to "reward the things that we think are good" and "punish the things that we think are bad."

Vance told Kirk, "So, you talk about tax policy, let's tax the things that are bad and not tax the things that are good. If you are making $100,000, $400,000 a year and you've got three kids, you should pay a different, lower tax rate than if you are making the same amount of money and you don't have any kids. It's that simple."

Moussa wrote on X, "JD Vance’s attacks on childless Americans is even vile. He called for HIGHER taxes on those without children."

The child tax credit effectively lowers taxes for families with children, so the Daily Caller and some Republicans framed Moussa’s claim as being against the credits. Moussa was responding to Vance’s case for parents paying a "different, lower tax rate" than nonparents.

Our ruling

Vance said Harris is "calling on ending the child tax credit."

Harris has not called for this; she has repeatedly expressed support for the child tax credit. The Biden administration approved an increase of the credit in 2021 so it covered more children and awarded more money per child. The White House has lobbied Congress to make the pandemic-era benefit permanent.

Vance’s claim that Harris has called to end something that she actually wants expanded is not only wrong, but ridiculous. We rate it Pants on Fire!

RELATED: Biden says expanded child tax credit sharply cut poverty for Black children; data shows he’s right

Our Sources

Megyn Kelly show, J.D. Vance on Democrats' Anti-Family Policies, Media Attacks, and Whether Biden Can Remain in Office, July 26, 2024

Fox News, JD Vance says 'anti-family' Dems took 'childless cat lady' remark out of context: 'Lie of the left', July 29, 2024

CNBC, Building the middle class may be a ‘defining goal’ under a Harris presidency — how that may shape a key tax credit, July 26, 2024

Forbes, The Future Of The Child Tax Credit In A Harris Administration, July 27, 2024

U.S. Treasury Department, Child Tax Credit The American Rescue Plan, Accessed July 29, 2024

U.S. Census Bureau, The Impact of the 2021 Expanded Child Tax Credit on Child Poverty, Nov. 22, 2022

CNN, House passes bipartisan tax bill that expands child tax credit, Jan. 31, 2024

NBC News, 'On life support': Senate Republicans are prepared to sink the child tax credit bill, April 10, 2024

WhiteHouse.gov, FACT SHEET: The President’s Budget for Fiscal Year 2025, March 11, 2024

WhiteHouse.gov, REMARKS BY VICE PRESIDENT HARRIS AT CHILD TAX CREDIT EVENT, June 21, 2021

WhiteHouse.gov, FACT SHEET: Vice President Kamala Harris leads Biden-Harris Administration Day of Action to Ensure Americans get the tax credits they deserve, Feb. 8, 2022

WhiteHouse.gov, Remarks by Vice President Harris encouraging all Americans to take advantage of critical tax credits, Feb. 8, 2022

X, Kamala Harris post, Feb. 1, 2024

The Daily Caller, Harris campaign staffer appears to ‘come out against’ child tax credit, July 26, 2024

X, Ammar Moussa post, July 26, 2024

ABC News, Vance argued for higher tax rate on childless Americans in 2021 interview, July 26, 2024

IRS.gov, Child Tax Credit: Most eligible families will automatically receive monthly payments. For everyone else, here are three steps to get help, July 2021

IRS.gov, Child Tax Credit, Accessed July 29, 2024.

Center on Budget and Policy Priorities, Policy Basics: The Child Tax Credit, Updated Dec. 7, 2022

Browse the Truth-O-Meter

More by Samantha Putterman

Kamala Harris has worked to expand the child tax credit, not end it, as JD Vance said

Support independent fact-checking.

Become a member!

In a world of wild talk and fake news, help us stand up for the facts.