Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

If Your Time is short

- The top rates apply to only very high income individuals, a small percentage of the population.

- The Tax Foundation analysis adds the top tax rates in every state with the top rate in the Biden plan. In every state, the state rates are different and apply to incomes at different levels.

The rapper and entrepreneur 50 Cent said that he didn’t want to become "20cent" after learning about Democratic presidential nominee Joe Biden’s tax plan.

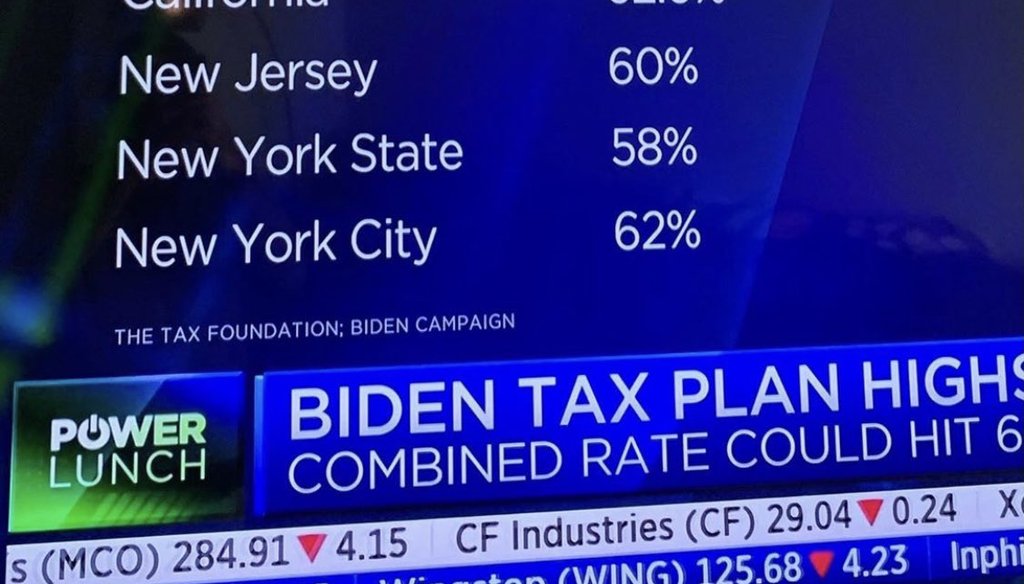

The entertainer posted a graphic from the CNBC show "Power Lunch" that listed the top tax rates by state under the Biden tax plan. New York state would have a top tax rate of 58 percent, and New York City would have a top tax rate of 62 percent, according to CNBC.

"I don’t care Trump doesn’t like black people 62% are you out of ya … mind," he tweeted. His tweet drew a lot of attention, including a cover story in the New York Post headlined: "50CENT SAYS: ‘I DON’T WANT TO BE 20CENT’ UNDER BIDEN TAX PLAN." The rapper urged his followers to vote for President Donald Trump, though he walked that back.

We wondered about Biden’s tax rate formulations and who would pay the top rate if he wins the election.

CNBC based its story on an analysis by the nonpartisan Tax Foundation, which has written favorably about the Repubican-led Tax Cuts and Jobs Act of 2017. The analysis looked at each state's existing top tax rate to figure out what the combined state and federal tax burden would be under the Biden plan. In three states -- California, Hawaii, and New Jersey -- as well as in New York City, the combined top marginal tax rate would exceed 60 percent. Across the rest of New York state, the combined top marginal tax rate would be 58 percent, though different scenarios would change these numbers slightly.

The marginal tax rate is the rate of tax on every dollar above a set threshold. If the top tax rate is applied to incomes above $400,000, then that rate is applied to only that taxable income that exceeds $400,000. In New York state, the top marginal rate is 8.82 percent, levied on annual incomes of just over $1 million for single filers and just over $2 million for married filers filing jointly. In New York City, there’s an additional income tax surcharge of 3.876 percent on income above $50,000, resulting in a top rate of 12.696 percent.

The foundation’s analysis takes Biden’s proposed top federal tax rate of 39.6%, up from the current 37%, and adds it to Social Security and Medicare taxes. It also considers a change to the Social Security tax, as Biden calls for it to be imposed on incomes above $400,000, in addition to its current status as a tax on the first $137,700 of wage income. Biden also calls for capping all itemized deductions at 28%, and restores a provision known as the Pease Limitation, which reduces the value of itemized deductions in certain circumstances.

While 50 Cent and his financial peers may worry about an increase to their tax rate, most taxpayers have no such concerns.

"Only a small percentage of taxpayers will see any of their income exposed to these combined top marginal rates, and effective rates are lower than marginal rates, which are the rates imposed on the last dollar of a taxpayer’s income," according to the analysis.

Other tax experts we spoke with said that looking only at the top rate does not give a complete picture.

In 2021, Biden’s proposal would increase taxes, on average, for the top 5% of households, and reduce taxes for the remaining 95%, according to an analysis from the American Enterprise Institute, which leans conservative.

Adding Biden’s tax plan with tax rates in different states has its own complexities. Income levels where the top state income tax rate is applied varies in every state, said Kyle Pomerleau, who wrote the AEI analysis. The top rate in Virginia kicks in at $17,000, but the top rate in California kicks in at $1 million, he said.

"I wouldn’t say these (top) rates would be ‘typical’ for taxpayers under Biden’s proposals," Pomerleau said. "They would only apply to very high-income individuals. Most taxpayers would either see no change in marginal rates, or a slight reduction."

Our Sources

Twitter, tweet, @50cent, Oct. 19, 2020.

Tax Foundation, "Top Rates in Each State Under Joe Biden’s Tax Plan," Jared Walczak, Tax Foundation, Oct. 20, 2020. Accessed Oct. 26, 2020.

Email interview, Kyle Pomerleau, resident fellow, American Enterprise Institute, Oct. 22, 2020.

Email interview, Lucy Dadayan, senior research associate, Urban Institute, Tax Foundation, Oct. 22, 2020.

Email interview, Jonas Shaende, chief economist, Fiscal Policy Institute, Oct. 23, 2020.

PolitiFact, "Photo shows Ice Cube and 50 Cent wearing Donald Trump hats," Oct. 20, 2020. Accessed Oct. 26, 2020.

American Enterprise Institute, "An analysis of Joe Biden’s tax proposals, October 2020 update," Oct. 13, 2020. Accessed Oct. 27, 2020.

FoxNews, "50 Cent hints Lil Wayne made a mistake meeting President Trump: 'Oh no'," Oct. 30, 2020. Accessed Oct. 31, 2020.